when are property taxes due in illinois 2019

At a Nearly 11 increase over the prior year 32234 in 2020 vs. The most common overlapping districts are used for illustrative purposes.

Cook County Treasurer S Office Chicago Illinois

090222 Per Illinois State Statute 1½ interest per month due on late payments.

. This filing and payment relief includes. 2021 Real Estate Tax Calendar payable in 2022 April 29th. Record inflation in 2022 will bring increases statewide in 2023.

There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. The charts below give a breakdown of where your property tax money goes by.

The Online Property Inquiry tool updates every hour to reflect the most recent payments. Macon County Property Tax Information. As you can see the City of Decatur receives 16 of property tax paid by residents.

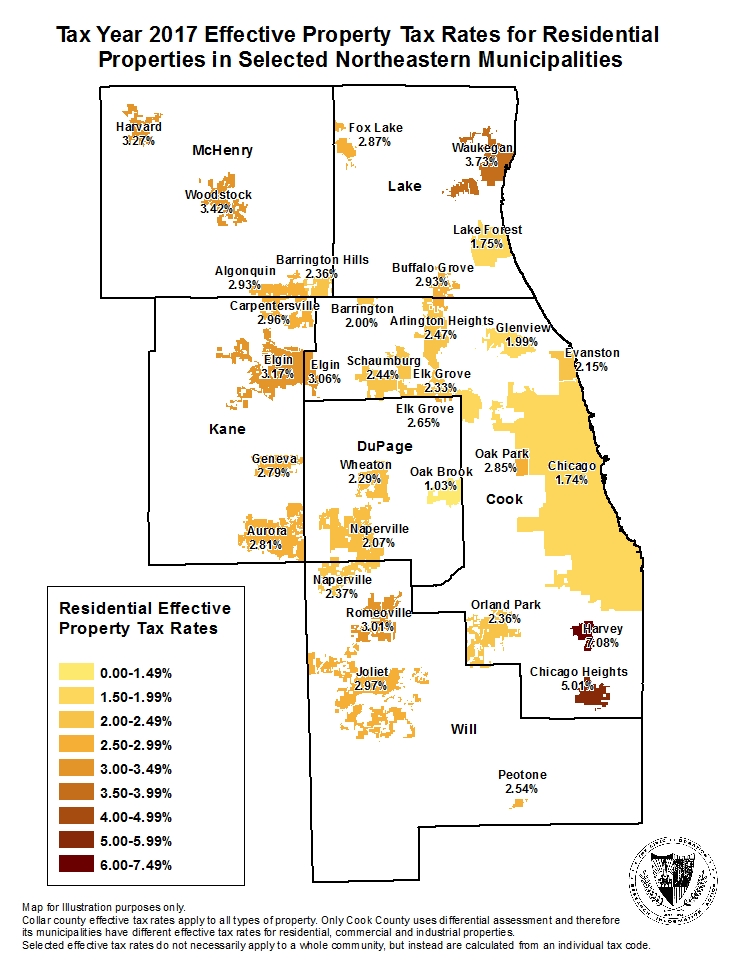

The effective property tax rate is calculated by taking the total amount of taxes paid on owner-occupied homes in a given area as a. Prepare your 2019 Illinois state return for 1799. 090522 LABOR DAY - OFFICE CLOSED.

It is managed by the local governments including cities counties and taxing districts. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. For context homeowners in the US.

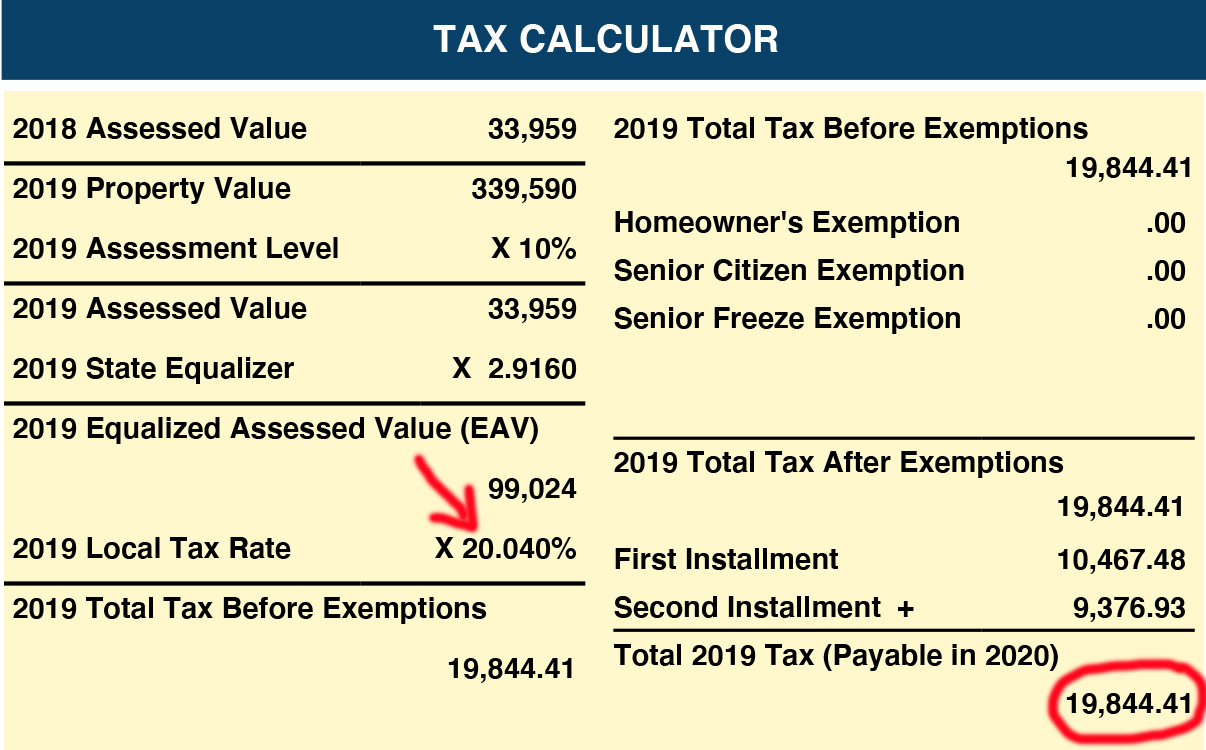

State of the Office. Assuming a tax rate of 98487 per 100 of EAV the amount of property tax due would be 761630 calculated as follows. Tax Year 2020 First Installment Due Date.

Chicago property taxpayers were asked for 164. Real estate tax due dates. Duties and Responsibilities of the Cook County Treasurer.

The 2020 tax bills payable in 2021 were mailed Friday May 7 2021. Ad Free prior year federal preparation Prepare your 2019 state tax 1799. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Last day to submit changes for ACH withdrawals for. Tax Year 2020 Second Installment Due Date.

The Illinois Department of Revenue Just Released the 2020 Cook County Multiplier. Freedom of Information Requests. Pay an average of 103 of their housing value in property taxes a year.

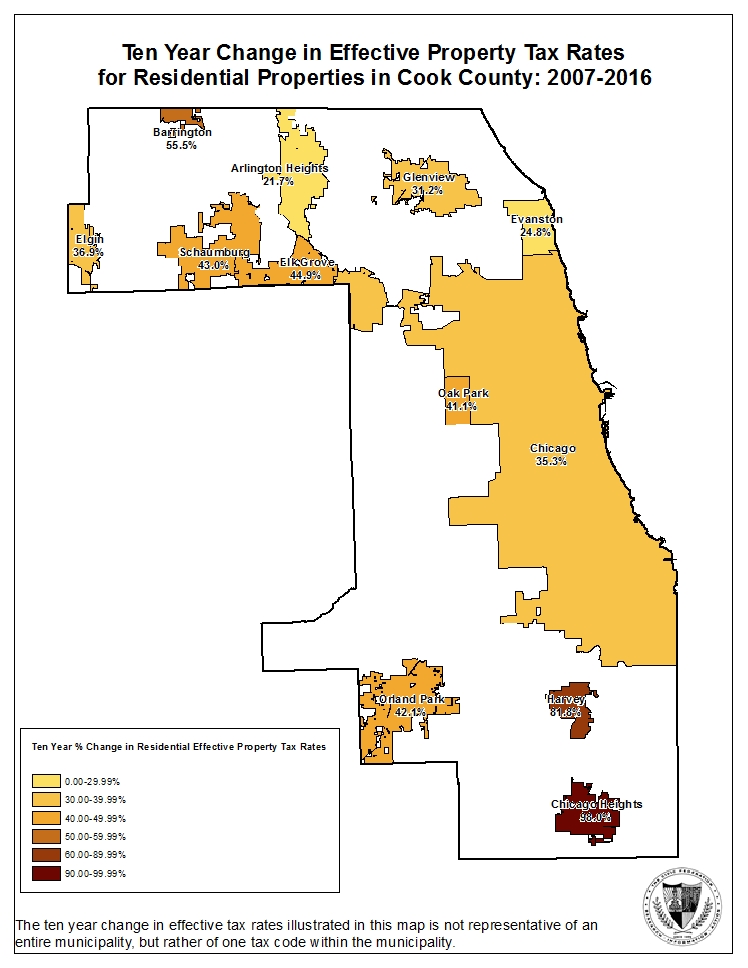

If you are a taxpayer and would like more information or forms please contact your local county officials. City property taxes rose 30 faster than in suburban Cook County from 2000 to 2019. Maria Pappas Cook County Treasurers Biography.

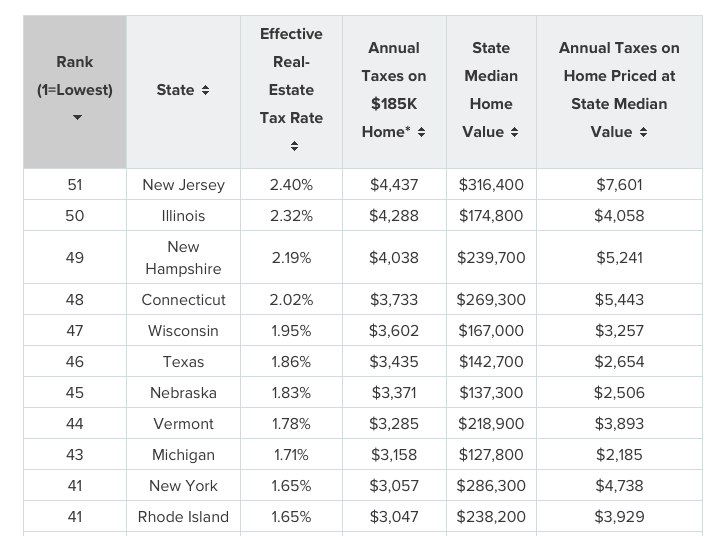

Across Illinois the effective annual property tax rate stands at 197 the second highest among states. There are several convenient ways to pay your real estate property taxes. The Illinois Department of Revenue does not administer property tax.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Illinois income taxes on April 15 2020 are automatically extended until July 15 2020. Tax Due Dates are AUG 3 and SEPT 4 See 2020 Real Estate Tax Bills Amounts will it available online on May 29 2020 Pay Taxes Here Print Tax Bills Here. 7733333100 x 98487 761630 Of this amount due the United City of Yorkville would receive 45487 6 Where does your property tax go.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. Welcome to Property Taxes and Fees.

Your real estate tax deduction for 2020 2019 taxes in Illinois are billed in 2020 is what you paid directly or was taken out of your escrow account less any credit on the closing statement for those taxes the Illinois credit is based on that deduction. Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. At one of many bank and credit union branches across Will County.

Tuesday March 1 2022. Property tax bills mailed. Friday October 1 2021.

See how your individual property taxes are distributed for any parcel and how to contact those taxing bodies on Lake Countys Tax Distribution website. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale.

Tax Year 2021 First Installment Due Date. Contact your county treasurer for payment due dates. 29160 in 2019 this variable represents a significant increase in a major factor in determining final 2020 taxes.

In person weekdays from 830 AM 430 PM at the Will County. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a. Due dates are June 7 and September 7 2021.

Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021. In most counties property taxes are paid in two installments usually June 1 and September 1. This page is your source for all of your property tax questions.

Duplicate bills are available on-line. Illinois Property Tax Credit on 2019 purchase. 090722 Sub-tax may be paid by tax buyer between 900 am.

2020 tax year to be collected in 2021. The Senior Citizen Real Estate Tax Deferral Program. Paying your Real Estate Tax Payments by Automatic Withdrawal Due Dates for the 2019 taxes payable in 2020 are as follows 1st installment due June 17.

This next chart and graph shows the City and overlapping governmental taxing districts. 090122 2nd installment due date. Maria Pappas Cook County Treasurers Resume.

Free prior year federal preparation. But if going to deed 3rd year of non-payment tax buyer may pay tax amount on May 13th. City of Decatur Property and Overlapping Governmental Tax Rates.

View maps of different taxing districts in Lake Countys Tax District Map Gallery. Yes to did you own your primary residence. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

The filing and payment deadline for Illinois income tax returns has been extended from April 15 2020 to July 15 2020.

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Property Tax City Of Decatur Il

Property Tax Village Of River Forest

Property Tax Prorations Case Escrow

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office

Dupage County Il Treasurer Sample Tax Bill

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

The Cook County Property Tax System Cook County Assessor S Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Dupage County Il Treasurer Sample Tax Bill

Expected 7 5 Billion In Federal Aid Won T Fix Illinois Budget Crisis Without Structural Reforms

Property Tax Village Of Carol Stream Il

Property Tax City Of Decatur Il

Cook County Triennial Property Tax Assessment Schedule Kensington